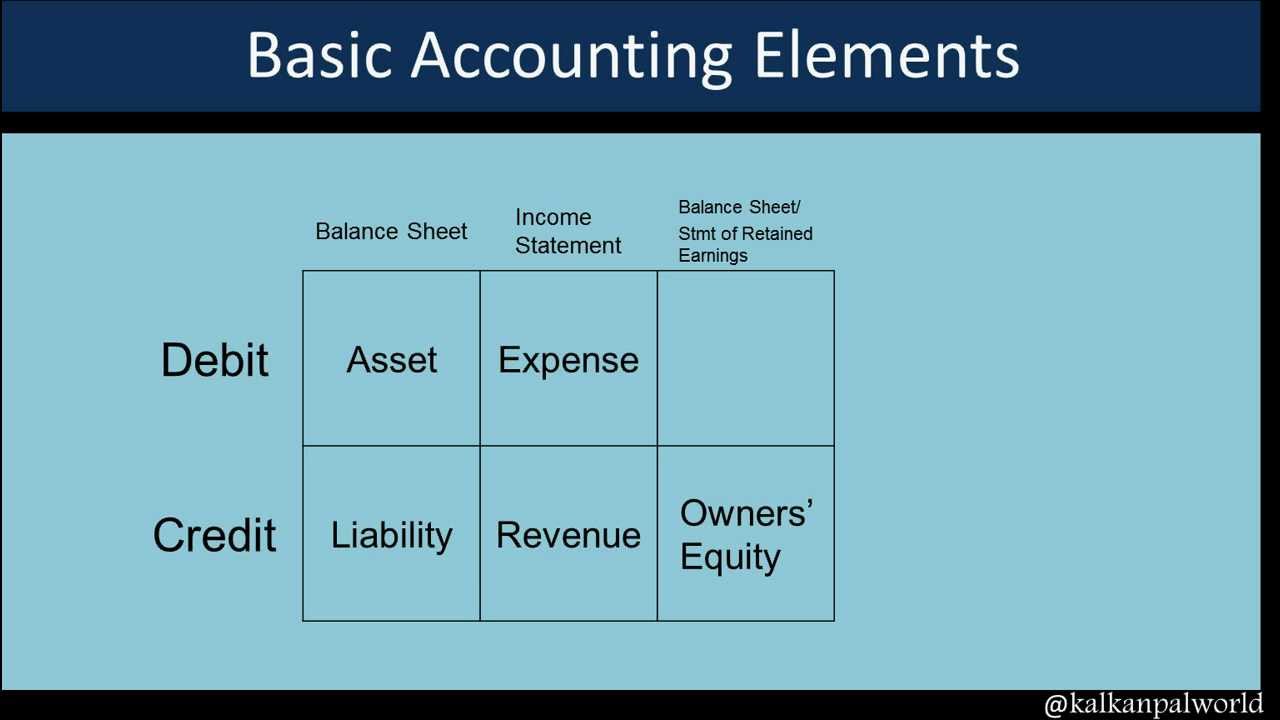

You can visualize this basic rule by looking at the above teeter-totter illustration. For example if an asset account is increased, the accounting equation can be maintained by increasing a liability or equity account or by decreasing another asset account. Notice this does not mean that one account necessarily increases when another account decreases. If there is more than one debit or credit in a transaction the total of the debits and credits must be equal.īecause assets must always equal the total of liabilities and equity, any increase in one account must be offset with an equal change to another account that maintains this equation. Here is the first rule of transaction posting:Įvery transaction involves at least one debit and one equal and offsetting credit. In accounting that is all these terms mean. “Debit” means left, “credit” means right. Most importantly, “ credit” does not refer to something good and “debit” to something bad. “Debit” does not always refer to an increase in an account balance nor does “credit” always refer to a decrease, or vice versa. “Debit” simply means the left side of the “T” account, and “credit” refers to the right side of the “T” account. Instead of saying “left side” and “right side” accountants use the terms “debit” and “credit”. The importance of the “T” structure is that it distinguishes between the left and right side of each general ledger account. For example think of the Cash account as looking like this: All general ledger accounts should be thought of as specially formatted records shaped as a big “T”. The collection of all accounts is called the general ledger. Information contained in these books of original entry must be transferred or posted to general ledger accounts.

Posting From Journals To General Ledger Accounts: Debits And Credits At a minimum, the written record should include the date of the transaction, the parties involved, the dollar amounts disbursed or collected, and the nature of the transaction.

The information captured from a recorded transaction is more important than the form used in recording it.

#Accounting debit credit software#

Such software automatically stores a complete record of the transaction as checks are generated. The most accurate and reliable method of record keeping utilizes computer software to create and print checks. These can be actual books or registers or virtual as in accounting software.Ĭlick here for an example of a cash disbursements journal. The most commonly used of these are the cash receipts and cash disbursements journals. Transactions are typically first recorded in specialized records called books of original entry.

0 kommentar(er)

0 kommentar(er)